Trading is full of regrets:

- I regret not selling on the way up.

- I regret selling too soon.

- I regret taking such a small position

- I regret taking such a big position.

- I regret holding through earnings.

- I regret not holding through earnings.

The list of regrets from trading could go on and on. And the fact is that all these regrets, for the most part, are due to the outcome of the trade which you have no control over.

Focus on what you can control, take full advantage of your strengths, minimize your weaknesses, know that there is no perfect system and that a lot that happens in trading could be chalked up as random.

On another note; I love the trading videos that over scrutinize and analyze losing trades like if they are not supposed to happen. Losses are unavoidable, tweaking your method every time you have a loss or series of losses is only going to drive crazy and make you chase something that does not exist.

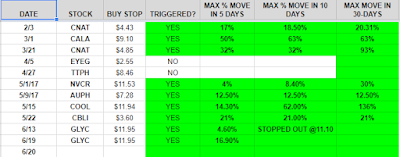

STOCK OF THE WEEK RECAP

Frank Zorrilla, Registered Advisor In New York. If you need a second opinion, suggestions, and or feedback in regards to the market feel free to reach me at fzorrilla@zorcapital.com or 646-480-7463.

We live in a world in which we are bombarded with information, tweets, blogs, etc., content is the new salesman, content is the new marketing, content is the new networking. With information being so readily available, bloggers try to differentiate themselves with their writing skills, volume, and consistency, putting out blog posts to meet quotas. We are seeking to stand out from the crowd by showing performance, by taking all the information and seeking alpha, that’s the sole purpose of the blog. It won’t always be pretty; it’s never easy, and performance is spotty, but we seek superior risk-adjusted returns, not notoriety for our writing skills. If this is something you can relate to, then this blog is for you.