This current bull market that started in 2009 by far is the most hated one I can recall. After two 50% corrections in the SP500 its easy to see why, many investors are still healing from those wounds. Some wounds don’t heal easily and the psychological effects normally lasts longer than the physical ones. You throw in how much information is available now and how easily it can be obtain you can understand why so many are on the edge every time the market ticks down. But know this; page views, sessions, users, blog quotas, etc..is what’s important to those that broadcast information, the more hits the better, hence why every uptick or down-tick in the SP500 is made out to be so important by the social financial media.

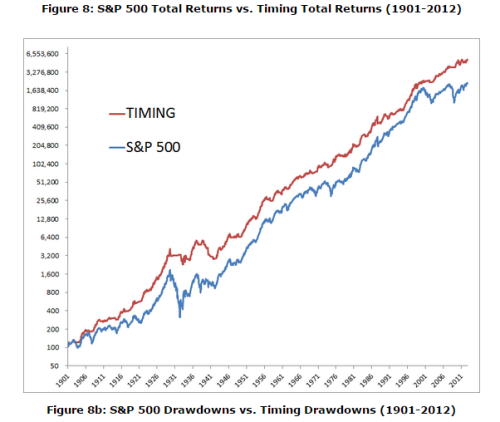

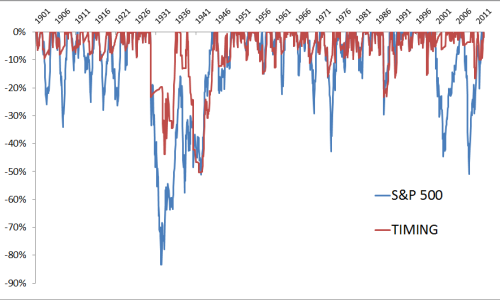

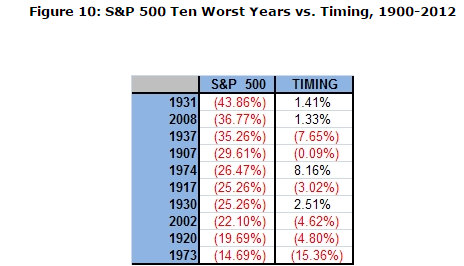

One of the best thing you can do as an investor/trader is to tune out the noise and accept the fact that you will never get out at the top or get in at the bottom. My suggestion is to stay optimistic about the market as long as it stays above the 200 day moving average (10 month moving average). There’s not one single strategy that’s perfect, however, this one has a decent track record of keeping you in without having to deal with all the noise. Meb Faber has done the best work on this, here are some of his charts on this subject.

SP500 Total returns vs. Timing Total returns (long above the 10 month average, out below the 10 month moving average).

No comments:

Post a Comment